Using "silver quarter" as a reference is confusing overall, since that apparently mainly refers to Washington quarters minted until year 1964 that did indeed have 90% silver. You wouldn't be able to buy 90% silver quarters for your wage in 1971 nor in 2025, unless of course you went to buy old coins that will have a significant collector value far beyond the silver price. So using them as reference is already strange... and to add further to the confusion, there are also Bullion coins which have different values and purity still.

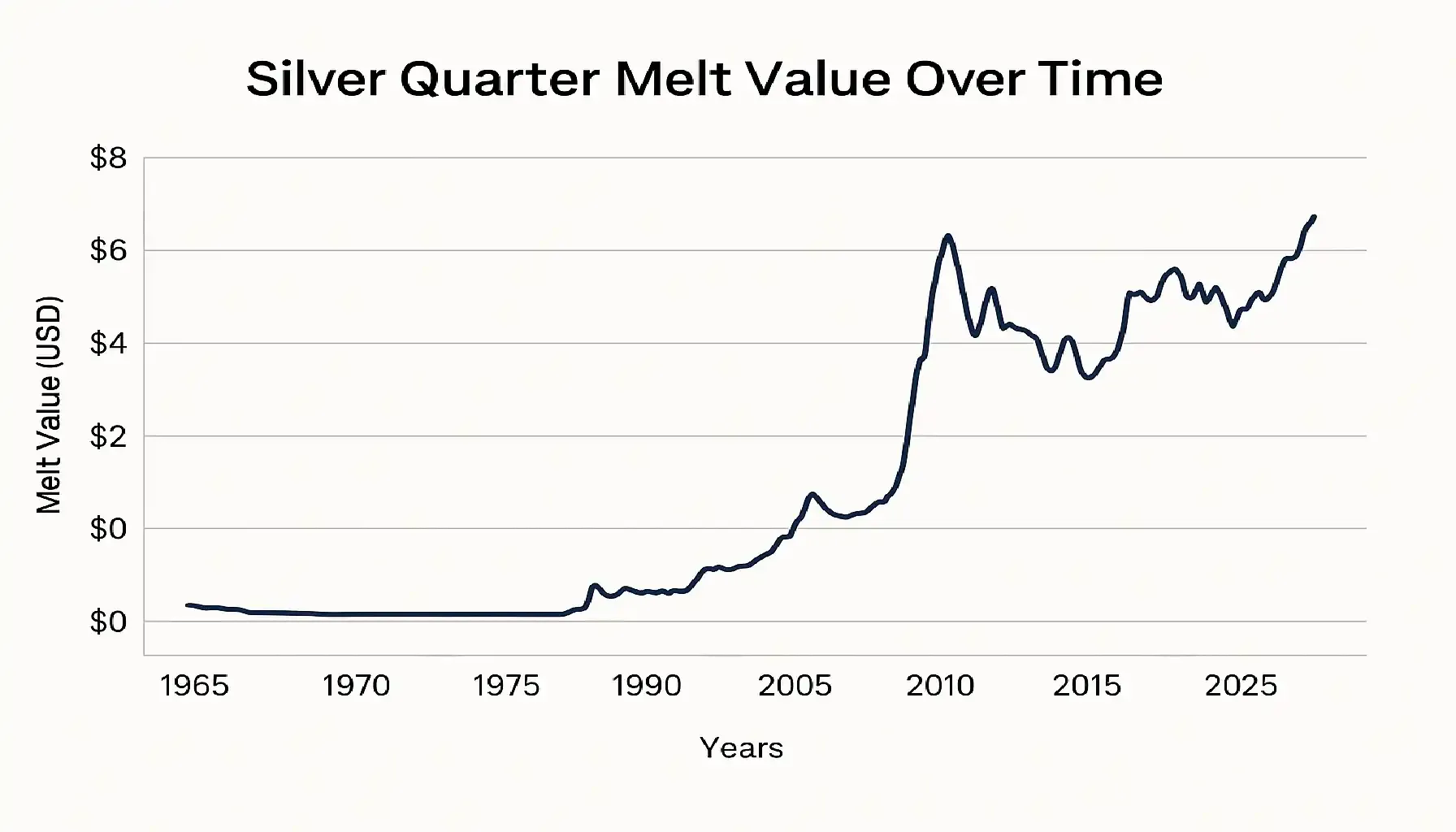

The silver price is not necessarily following the consumer index, that is the average price for food and goods. Since the 1960s, the whole electronics industry has emerged, and also a growing chemistry industry, making silver much more valuable than in the past, when it was mainly used for vanity items. Silver as an investment claims that 40% of all silver use today is industrial. That wouldn't have been the case back in the 1960s - you can see how silver has become far more valuable since then in the graph further below.

Furthermore, gold and silver are nowadays popular for "day trading" investments, making their prices go up in times of trouble and regular stock market instability. So there's not really much relevance to measure your wage in silver - most people don't blow their wage on silver. In fact the overwhelming majority of employed humans (approximately 100%) tend to spend part of their wages on food. So it would make more sense to use some every day food item like milk or grain etc, or better yet a bag of food containing some 20 common food items. That would also take inflation in account, unlike silver which doesn't necessarily follow the inflation of any particular currency.

As of today 2025, the melt value of a 1964 Washington silver quarter is $9. According to this site the melt value of a silver quarter in 2021 was approximately $5.5, see this graph:

So yeah that's similar to the claim in your second link, however we can clearly spot some troubled times in this graph, like the financial crisis of 2008 or the Covid pandemic of 2020. There is no relation between low minimum wages and the high silver prices due to the on-going Covid pandemic in 2021.

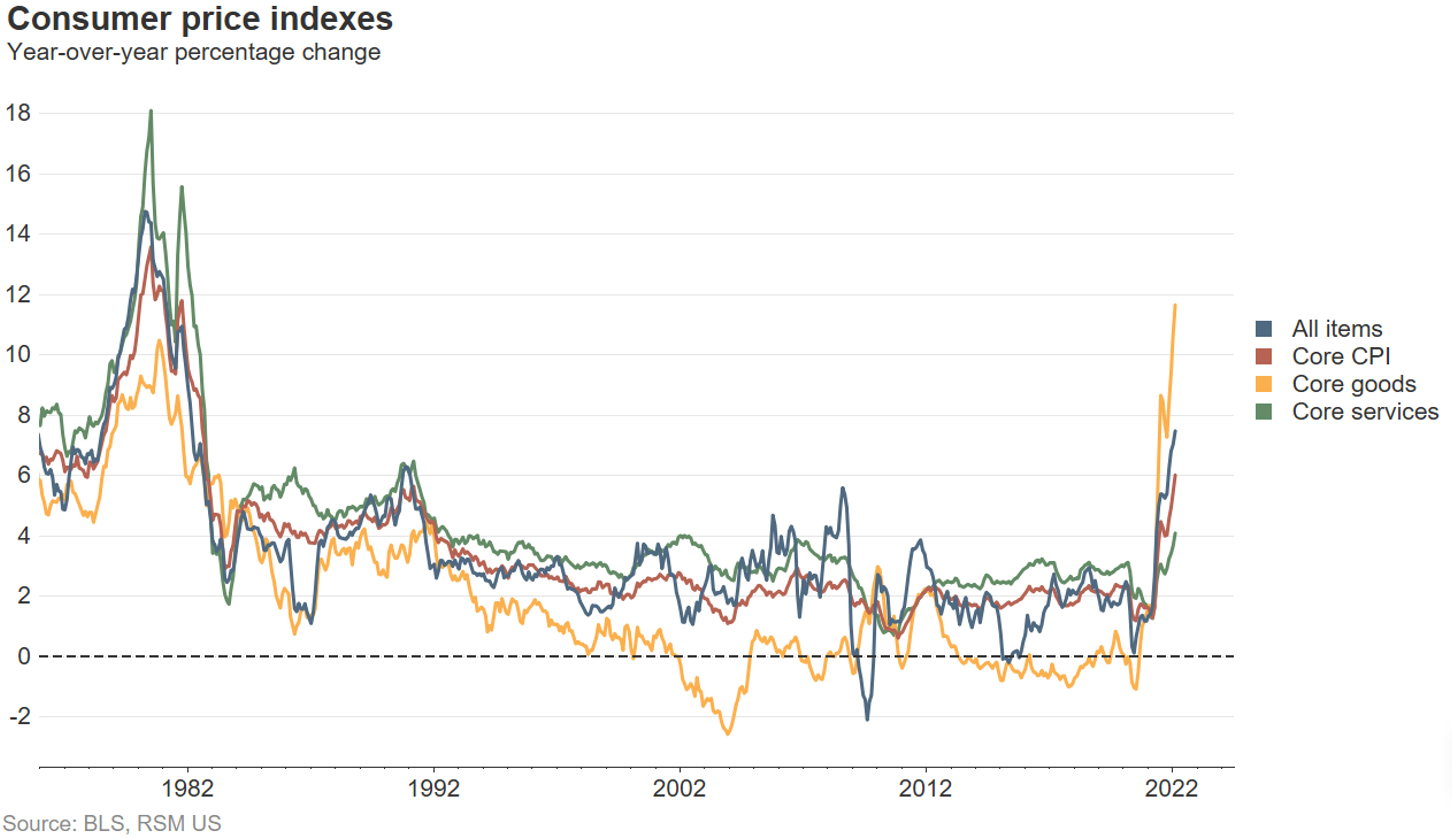

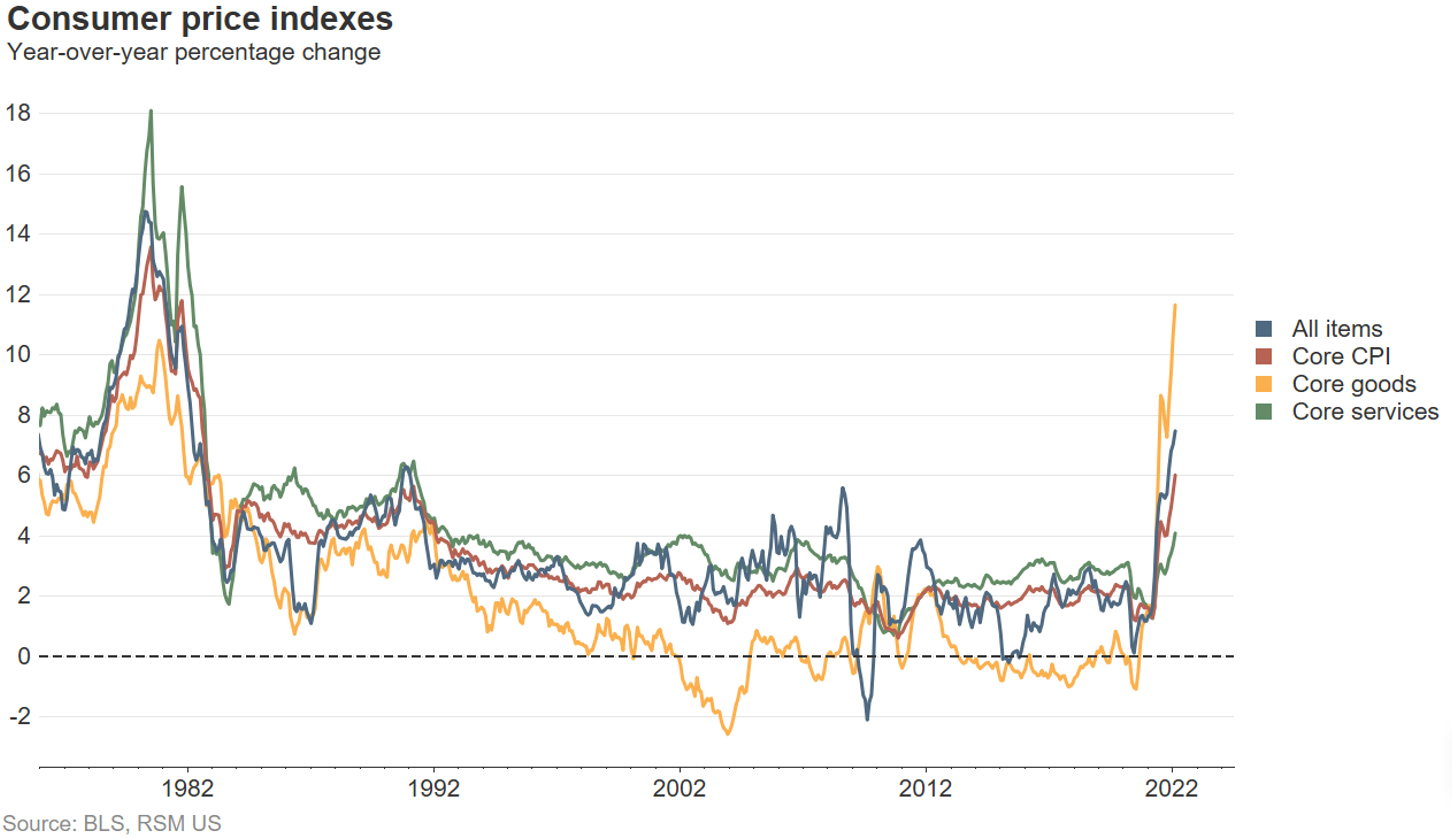

Now compare that to US consumer price index during the pandemic:

There was a notable inflation starting around 2020 during the pandemic.

From all of this, I think we can at least make the conclusion that there is no correlation between what you will get for your wage in USD compared to the price of silver.